Homeowners Insurance in and around Spokane Valley

Looking for homeowners insurance in Spokane Valley?

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

With your home covered by State Farm, you never have to worry. We can help you make sure that in the event of damage from the unpredictable falling tree or burglary, you have the coverage you need.

Looking for homeowners insurance in Spokane Valley?

The key to great homeowners insurance.

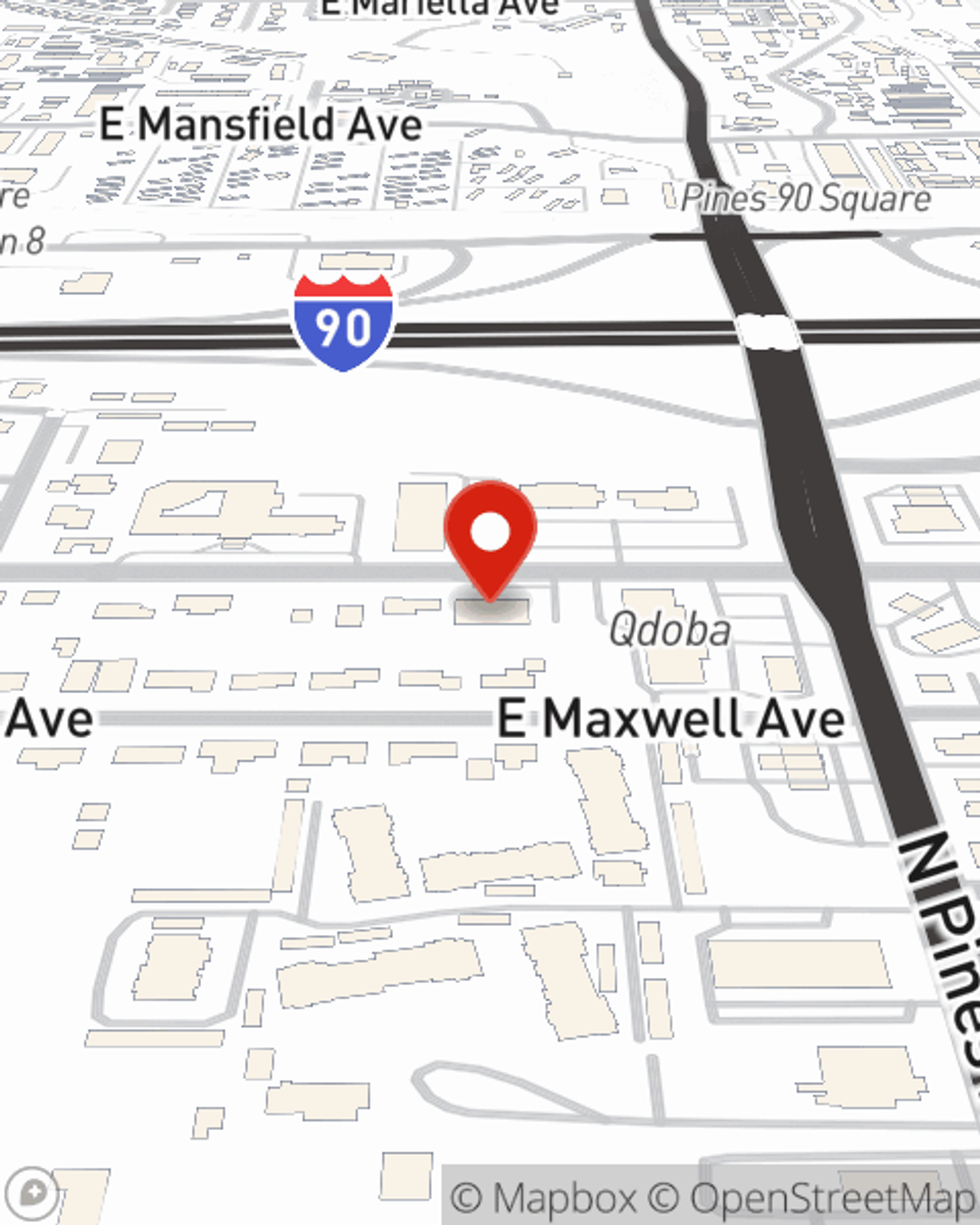

Agent Dave Christy, At Your Service

State Farm Agent Dave Christy is ready to help you prepare for potential mishaps with dependable coverage for your home insurance needs. Such attentive service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If if trouble knocks on your door, Dave Christy can help you submit your claim. Find your home sweet home with State Farm!

As your good neighbor, State Farm agent Dave Christy is happy to help you with creating your homeowners insurance plan. Call or email today!

Have More Questions About Homeowners Insurance?

Call Dave at (509) 926-1345 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Things to consider when replacing a roof

Things to consider when replacing a roof

When your house needs a roof replacement, you might wonder what material and warranty options there are. Learn about some questions to ask a roofing contractor.

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

Dave Christy

State Farm® Insurance AgentSimple Insights®

Things to consider when replacing a roof

Things to consider when replacing a roof

When your house needs a roof replacement, you might wonder what material and warranty options there are. Learn about some questions to ask a roofing contractor.

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.